There’s a Latin saying that was a favourite of the Roman emperor Augustus; festina lente. The literal translation is ‘make haste slowly,’ though the more common English version is ‘more haste, less speed.’

It would be a great motto for mortgage bankers because it captures the balance that has to be struck between the need for diligence, on the one hand, and the customer’s desire to move quickly on the other.

Typically the process through to closing takes over 30 days. Lately the baseline has been more like 45 days and you can add extra days to that if the FHA or Veterans Affairs are involved while, according to Forbes1, the pandemic added another two to three days to the process.

For those who were refinancing, as opposed to purchasing, the timeline in the twelve months since March 2020 grew by a blood-pressure-raising 11 to 14 days over the previous year, presumably because of demand and because refinancing was the thing that had to give when COVID threw a wrench in the works of everyone’s processes.

Now, what if I told you the timeline to close could be shrunk to 20 days without compromising on diligence or running afoul of the regulatory environment?

Whether, as a mortgage banker, you’d like to close and fund as many high quality mortgages as possible so you can start the cycle again, or whether you’re placing mortgages in the secondary market, faster means more throughput, more productivity, more business, more profit. It also means you become the outfit known for getting things done fast and that makes you very attractive to anyone looking for a mortgage.

Hold on to your ‘geddawaywhydoncha’ for a moment. It’s not magic. It’s not rocket science either. But it is artificial intelligence.

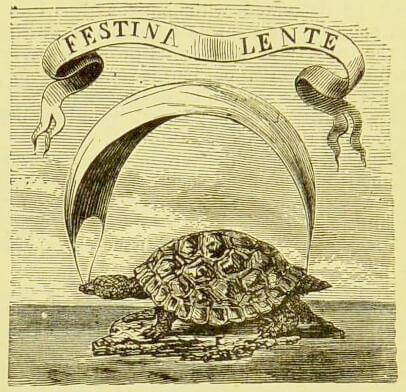

One of the major bottlenecks to mortgage application processing is the sheer volume of information needed; standard documents that have to be submitted and received; W-2 forms, pay stubs, bank statements and tax returns from the borrower side and all the federally mandated forms; appraisals, title searches, credit reports and so forth.

The amount of paperwork never shrinks, does it?

After approval there are more documents – loan packets often run to 400 pages. Then the legal team gets involved, followed by the closing agent – all needing to review the documentation. And that’s all before we get to the funding stage. And did I mention all the letters and emails that come in every step of the way?

In an ideal world much of this process would be automated, the data would be digitised, systems would work seamlessly together and the flow of information wouldn’t be a brake on the process.

In practice much of the information is passed around in hard copy and that is S.L.O.W. Where documents are digitised the digitisation process is often dependent on technology like Optical Character Recognition, and that’s showing its age. On its own OCR can only handle documents and data in tightly ‘structured’ formats which means much of the process still relies on manual data input. That is also slow. Automate prequalification, income verification, the collection of borrower data, appraisal, title search, title insurance, and the decision and you can shave weeks off the entire timeline.

Cognitive Machine Reading (CMR) makes use of OCR but augments it with advanced pattern recognition based on fractal science so that it not only handles documents and data that aren’t in structured formats – for instance reports, letters, emails, forms, contracts – it’ll also process images, stamps, signatures and even handwriting.

Even more remarkable, advanced Intelligent Document Processing technology, such as AntWorks’ CMR Plus, ‘understands’ context so data from internal and external sources is integrated and ends up in the right place. Yes, there’s is a need for humans in the loop for quality control so everything ends up as near perfect as possible.

But CMR Plus (which only needs a couple hundred documents for training purposes) learns continuously and just gets quicker and more accurate, so, the amount of manual intervention reduces.

What you do with the time you save is totally up to you. You could start the cycle again more quickly. You could devote more time to specific stages of the process. For instance, you could allow for manual intervention in applications that typically don’t get approved automatically but that need an expert eye to assess risk and eligibility – i.e. where an applicant has changed job recently, applied for a loan, or received a lump-sum payment. The point is, having more of your people’s time freed up gives you more choices.

In an industry where accuracy matters and where speed gives a competitive advantage, automation technology that offers both may determine which players grow and which fall by the wayside. Automation is coming, like it or not. The question is really one of whether you lead the market or follow.